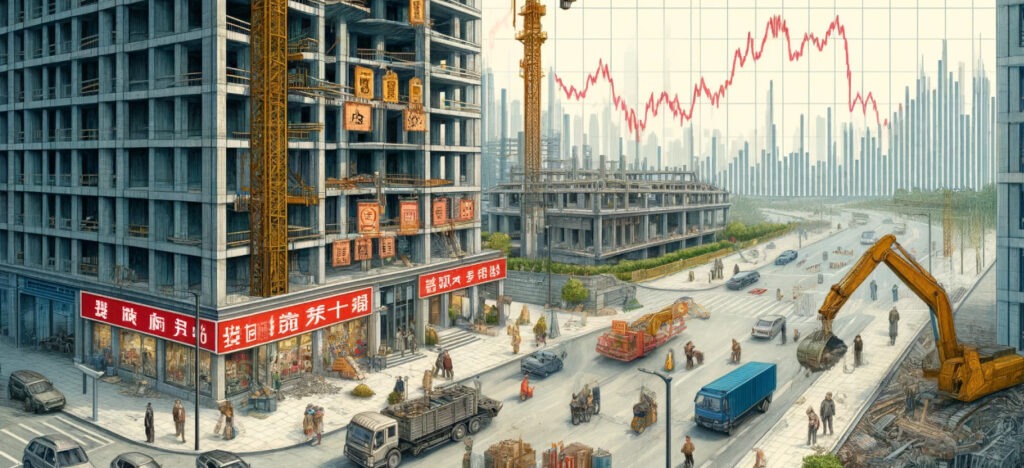

El Impacto del Fin del Financiamiento Barato en los Mercados Globales

Recientes caídas en los mercados de acciones a nivel mundial parecen estar más relacionadas con el cese del financiamiento a bajo costo que con la situación económica de Estados Unidos, según expertos del sector.

Aunque los recientes datos de empleo en EE. UU., que resultaron menos alentadores de lo esperado, fueron un detonante, no son el principal motor detrás de estas fluctuaciones significativas.

El declive más notable se observó este lunes en el índice Nikkei de Japón, que experimentó su caída diaria más pronunciada desde el famoso Lunes Negro de 1987. Sin embargo, analistas indican que el verdadero influjo proviene de la liquidación de las operaciones de carry trade. En estas operaciones, los inversores han estado tomando préstamos en países con tasas de interés bajas, como Japón o Suiza, para invertir en mercados de mayor rendimiento.

Este enfoque resultó contraproducente cuando el yen japonés se apreció más de un 11% frente al dólar en el último mes, situándose en niveles no vistos en casi cuatro décadas. “Este movimiento del mercado se debe en gran parte a la capitulación de algunas posiciones, ya que varios fondos se encontraron apostando por el lado equivocado”, explica Mark Dowding, director de inversiones de BlueBay Asset Management.

A esto se suma la sorpresa generada por la reciente subida de tasas por parte del Banco de Japón, lo que ha llevado a una reevaluación de las expectativas sobre la política monetaria futura y ha causado un repliegue en las acciones, particularmente las tecnológicas en EE. UU., que se han visto muy afectadas.

Al cierre del lunes, el índice tecnológico Nasdaq de EE. UU. registró una bajada superior al 8% solo en agosto, destacando un desajuste mayor en comparación con el índice S&P 500 que cayó un 6%. Los préstamos transfronterizos en yenes han mostrado un incremento de $742 mil millones desde finales de 2021, influyendo en estas dinámicas de mercado, de acuerdo con datos del Banco de Pagos Internacionales.

El efecto en los fondos de cobertura

Los ajustes en las estrategias de inversión de los fondos de cobertura, que suelen financiar sus apuestas con préstamos, están intensificando las oscilaciones del mercado. Según Goldman Sachs, aunque el apalancamiento bruto ha disminuido, sigue estando cerca de los máximos de los últimos cinco años.

En un contexto de regulaciones más estrictas en mercados como Corea del Sur y China, muchos fondos han trasladado sus operaciones a Japón, incrementando la volatilidad en este mercado. A pesar de la turbulencia, los analistas anticipan que el ajuste de posiciones será breve y no esperan un impacto prolongado en el mercado.

Los operadores están ajustando sus expectativas y ahora anticipan más recortes en las tasas de interés de EE. UU. para finales de año, una señal de que, aunque el panorama sigue siendo incierto, el mercado podría estar ajustándose a una nueva realidad económica sin necesariamente anticipar un colapso. “Es prematuro reevaluar fundamentalmente la perspectiva económica basándose solamente en la volatilidad del mercado”, concluye Dowding.

“Lo que estamos viendo es una descompresión del mayor carry trade en la historia, lo que inevitablemente conlleva algunas consecuencias”, señala Kit Juckes, estratega jefe de divisas de Societe Generale.

Resiliencia y Desafíos: El Panorama Económico de México en el Contexto Global Actual

El reciente análisis de las fluctuaciones en los mercados globales sugiere que más allá de los movimientos momentáneos, factores estructurales, como el fin del financiamiento barato, son claves en las dinámicas de mercado. Sin embargo, para entender cómo estas condiciones afectan a economías emergentes como México, es crucial considerar sus fortalezas, oportunidades, debilidades y amenazas en un contexto integrado.

La economía mexicana se beneficia de una diversificación significativa. Sectores como la manufactura, automotriz, aeroespacial y agroindustria no solo son robustos sino también resilientes ante choques externos. Esta diversificación se complementa con la ventaja de numerosos tratados de libre comercio, como el T-MEC, que abren las puertas a mercados clave y brindan ventajas competitivas sustanciales.

Además, México cuenta con una mano de obra altamente calificada y especializada, atractiva para la inversión extranjera directa, y una infraestructura en constante mejora que incluye puertos, aeropuertos y redes de telecomunicaciones, fortaleciendo aún más su competitividad.

El fenómeno del nearshoring, impulsado por la tendencia de acercar las cadenas de suministro a Estados Unidos, ofrece grandes oportunidades para el sector manufacturero mexicano, permitiendo reducir costos y tiempos de logística. El crecimiento en la adopción de tecnologías avanzadas y la digitalización en diversos sectores prometen impulsar la productividad y la eficiencia.

En el ámbito de las energías renovables, la expansión de proyectos alineados con políticas de sostenibilidad abre nuevas vías para inversiones y desarrollo sostenible. Asimismo, los programas de apoyo y financiamiento para las PYMEs son esenciales, pues fomentan la innovación y el crecimiento empresarial.

Sin embargo, existen debilidades significativas. La economía mexicana tiene una alta dependencia del comercio exterior, especialmente de EE. UU., lo que representa un riesgo en caso de desaceleración económica en ese país. La burocracia, corrupción e inseguridad son obstáculos que reducen la eficiencia y la competitividad, afectando la percepción y confianza de los inversores y elevando los costos operativos. Además, la desigualdad regional limita el crecimiento inclusivo.

Las fluctuaciones en los mercados internacionales pueden impactar negativamente las exportaciones y la economía local, añadiendo un nivel de incertidumbre. Cambios en políticas comerciales por parte de socios estratégicos y la creciente competencia de otros países en sectores clave son riesgos para la estabilidad y el crecimiento económico de México. Además, los impactos climáticos representan un desafío creciente para la infraestructura y la producción.

En resumen, mientras que la economía mexicana se enfrenta a retos significativos, sus fortalezas y las oportunidades emergentes ofrecen un contrapeso efectivo. La capacidad para navegar en este entorno complejo dependerá de cómo se manejen tanto las debilidades internas como las amenazas externas, asegurando así un futuro económico estable y prometedor en el panorama global cambiante.

Colaboración: Editorial Auge | Reuters (Internacional).