Under pressure in China, Mercedes lowers its earnings outlook

Mercedes-Benz (MBGn.DE) lowered its annual profit margin forecast after weak second-quarter sales and earnings on Friday, but expects new models to help it face stiff competition in China in the second half of the year.

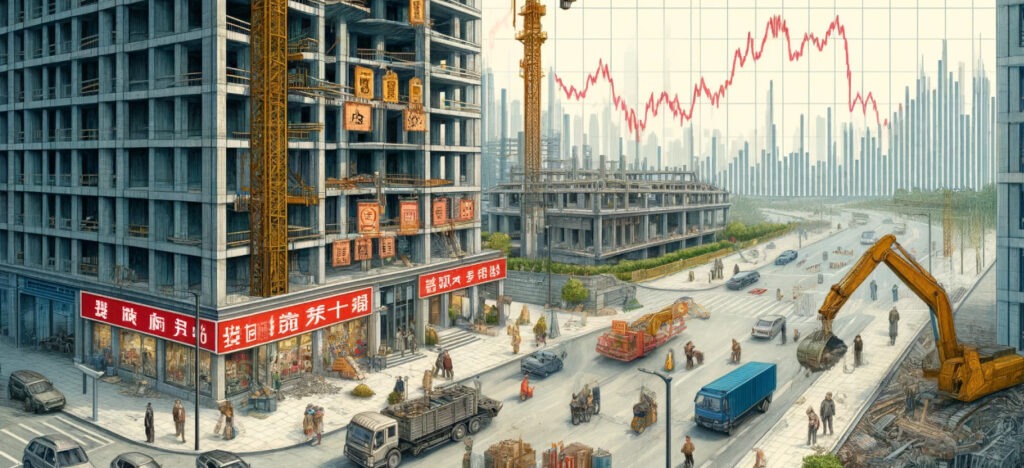

German automakers have been struggling with lackluster demand for electric vehicles (EVs), coupled with stiff local competition in China, supply bottlenecks and persistently high interest rates.

Mercedes said it expects plug-in hybrid sales to increase in the second half of 2024, as the industry in Europe and the U.S. sees increased demand for hybrid models, while EV sales have fallen short of expectations.

The automaker expects an adjusted return on sales in the range of 10-11% this year, down from its previous target of 10-12%.

The lower forecast sent the company's shares down 1.4% in early trading.

Bernstein analysts wrote in a note to clients that while some investors were expecting an earnings warning, the fact that Mercedes has simply lowered its margin forecast "will likely be met with relief."

The company's automotive division achieved a 10.2% return on sales in the second quarter, while its adjusted earnings were below analysts' expectations.

Mercedes reported a 6% drop in sales in the first half, with electric vehicle sales falling by 17%.

"Overall, Mercedes execution has recovered, but overall sales and high-end sales mix have remained weak," Citi analysts wrote in a note to clients.

Mercedes said the economic outlook was marked by uncertainty, adding that it saw improved market sentiment in Europe and "solid momentum" for sales and demand in the U.S. market.

However, it has a "cautious view" on China, where it expects strong competition in its entry-level and core model segments, while "seeking to successfully defend its leadership position" in high-end models.

CEO Ola Kaellenius told investors on a conference call that the automaker will continue its flexible approach to offering consumers both fossil-fuel and electric models based on demand.

But he said the company has to compete with EVs in China because of the pace of adoption of electric models in the world's largest car market.

"It's a race you have to be in," Kaellenius said.

The group reported a 27.5% drop in adjusted earnings for its auto division in the second quarter, versus LSEG's estimate of a 26% drop.

At the group level, earnings before interest and taxes (EBIT) fell in the quarter by 19.1% in line with the LSEG consensus.

Collaboration: Grupo Auge | Reuters (International).