China's economy falters, increasing pressure for more stimulus

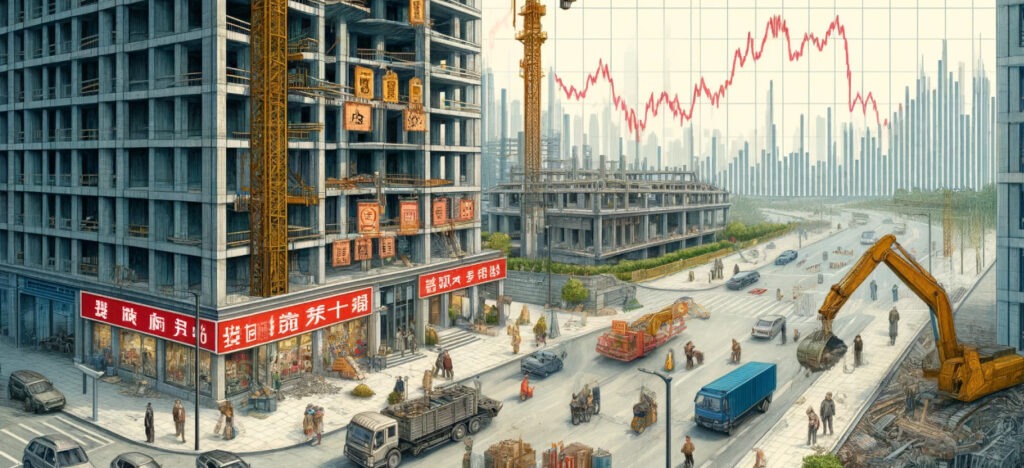

China's economy grew much slower than expected in the second quarter as a prolonged slump in the property sector and job insecurity held back a fragile recovery, keeping alive expectations that Beijing will need to release even more stimulus.

Of particular concern was the consumer sector, with retail sales growth falling to its lowest level in 18 months as deflationary pressures forced companies to cut prices on everything from cars to food and clothing. "Overall, the disappointing GDP data shows that the path to achieving the 5% growth target remains challenging," said Lynn Song, chief China economist at ING. "A negative wealth effect due to falling property and stock prices, as well as low wage growth amid cost-cutting in various industries, is dragging down consumption and causing a shift from big purchases to basic 'eat, drink and play' consumption," she added.

The world's second-largest economy grew by 4.7% in April-June, according to official data, its slowest pace since the first quarter of 2023 and below the 5.1% forecast in a survey. It also slowed from the previous quarter's 5.3% growth.

Among those affected was Swatch Group (UHR.S), the world's largest watchmaker, which reported a sharp drop in sales and profits amid weak demand in China.

The years-long real estate crisis deepened in June as new home prices fell at the fastest pace in nine years, affecting consumer confidence and restricting the ability of indebted local governments to generate new funds through land sales. Analysts expect that reducing debt and boosting confidence will be the main focus of a key economic leadership meeting in Beijing this week, although solving one of those problems may make solving the other more difficult.

The government is targeting economic growth of around 5.0% by 2024, a goal that many analysts believe is ambitious and may require further stimulus. The sharper-than-expected slowdown in growth in the second quarter prompted Goldman Sachs to cut its 2024 growth forecast for China to 4.9% from 5.0%. "To counter weak domestic demand, we believe further policy easing is needed for the remainder of this year, especially on the fiscal and housing fronts," Goldman Sachs economists led by Lisheng Wang said in a note on Monday. On a quarterly basis, growth was 0.7% from a downwardly revised 1.5% in the previous three months, according to data from the National Bureau of Statistics (NBS).

To counter weak domestic demand and the real estate crisis, China has increased investment in infrastructure and earmarked funds for high-tech manufacturing.

China's yuan and stocks fell after disappointing data, but stock markets closed higher after investors bet on more stimulus. NBS said that while bad weather was responsible for some of the impact on growth in the second quarter, the economy faced growing external uncertainties and domestic difficulties in the second half of the year. Economic growth in China has been uneven, with industrial production outpacing domestic consumption, stoking deflationary risks amid a slumping real estate sector and rising local government debt. While strong Chinese exports have provided some support, rising trade tensions now pose a threat.

Largely reflecting those trends, separate data on Monday showed that factory output growth beat expectations in June, but still slowed from May. That follows data released earlier this month that showed China's June exports rose 8.6% from a year earlier, while imports unexpectedly declined 2.3%, suggesting manufacturers were frontloading orders to get ahead of trading partner tariffs.

The biggest pain point on Monday, however, was seen in retail sales, which rose 2.0% y-o-y, missing forecasts and posting the slowest growth since December 2022. "Among all the monthly figures released today, the highlight is weak retail sales," said Xing Zhaopeng, senior China strategist at ANZ.

"Household consumption remains very weak...with employers cutting wages and high youth unemployment, households will remain cautious in the future," Xing added. Property investment fell by 10.1% in the first half of 2024 from a year earlier, and home sales by area declined by 19.0%. June bank lending, released last week, showed demand faltering again, with some key indicators hitting record lows. To shore up growth, China's central bank governor last month pledged to maintain a supportive monetary policy stance.

Analysts surveyed expect a 10 basis point cut in China's one-year prime lending rate, as well as a 25 basis point reduction in banks' reserve requirement ratio in the third quarter. Citi analysts expect the government to release another round of property support measures after a meeting of the Politburo, a high-level decision-making body of the ruling Communist Party, scheduled for late July following this week's Central Committee meeting.

In May, authorities allowed local state-owned enterprises to buy unsold finished homes, with the central bank setting up a 300 billion yuan re-lending loan facility for affordable housing. "While the case for reform is high, it is unlikely to be a particularly exciting affair," said Harry Murphy Cruise, an economist at Moody's Analytics. "Big policy changes can be taken as an admission of failure and a sure way to lose face...assuming the reforms are only modest, we expect China will only manage to achieve its 'around 5%' target for the year," he added.

Collaboration: Grupo Auge | Reuters (International).