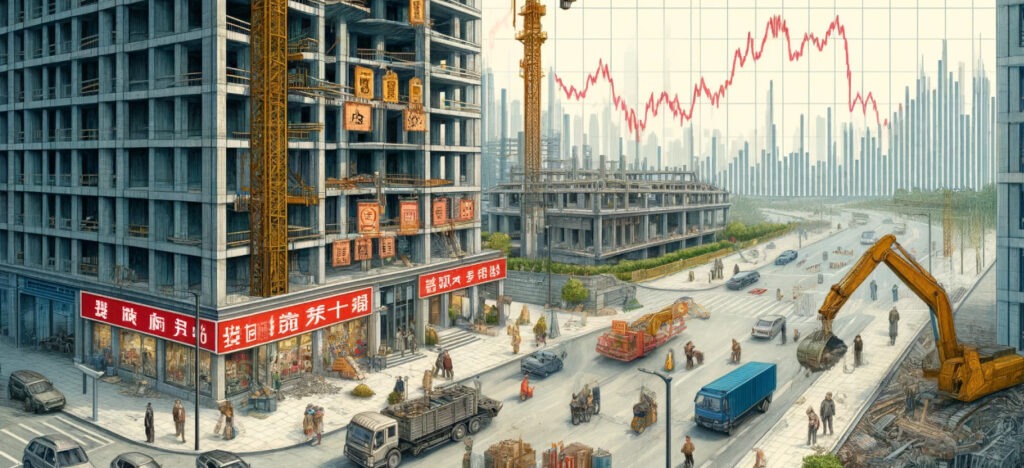

Real estate investment in dollars: the best option in times of uncertainty

With 6% of projected availability by 2024 in the multifamily segment, the U.S. real estate market remains a solid option to protect equity in the face of instability in Mexico.

The U.S. real estate market continues to be an attractive haven for Mexican investors in the midst of the economic uncertainty in Mexico.

As risk mitigation is sought, dollar investments in the U.S. multifamily and industrial sectors have gained momentum due to their relative stability and ability to offer sustainable returns.

Despite the recent complications faced by the Real Estate In general, these segments remain solid pillars. The availability rate in multifamily properties, for example, is estimated to remain low at around 6% by the end of 2024, reflecting a market with steady and growing demand.

One of the great strengths for Mexican investors in the U.S. real estate sector is the possibility of diversifying their portfolios in a strong currency such as the U.S. dollar, which allows them to protect their assets from the exchange rate volatility that affects emerging economies.

This currency stability provides a level of security that is difficult to obtain in markets with currencies more vulnerable to depreciation.

The multifamily market, driven by urban population growth and rental preference, stands out for generating predictable and consistent income, which reinforces its long-term appeal.

Within the opportunities presented, the industrial sector continues to show remarkable growth, particularly driven by the expansion of e-commerce.

The 8.5% increase in this sector reflects the growing demand for logistics infrastructure, which in turn favors investment in industrial warehouses and distribution centers.

This phenomenon responds to a structural change in consumer habits, especially in an increasingly digitalized world, consolidating the industrial sector as a key opportunity for those seeking to invest in segments with high profitability potential.

However, the environment presents certain weaknesses for investors to consider. For many, direct investment in U.S. property may seem complex, expensive and out of reach.

In addition, managing properties from abroad can involve logistical and administrative complications, which limits the attractiveness for some stakeholders. Despite these barriers, there are platforms that have facilitated access to these markets through investment funds that allow a more accessible entry with minimal investments, thus simplifying diversification in sectors such as multifamily and industrial.

Among the threats that could affect Mexican investors is possible instability in U.S. economic policy. Changes in interest rates or regulatory policies could influence the behavior of the real estate market, affecting expected returns.

In addition, increasing competition in the multifamily and industrial market could put pressure on profitability margins, requiring investors to keep a constant watch on trends and changes in these sectors. Despite these potential challenges, dollar diversification remains a relevant strategy for those seeking to mitigate risks and take advantage of opportunities in the U.S. market.

The combination of a strong currency, growing demand in specific segments, and ease of access through innovative platforms positions the U.S. real estate market as a solid option for Mexican investors. While there are challenges and threats to consider, the strengths and opportunities provided by this market continue to be a powerful incentive for those seeking stability and growth in uncertain times.

Collaboration: Editorial Auge.