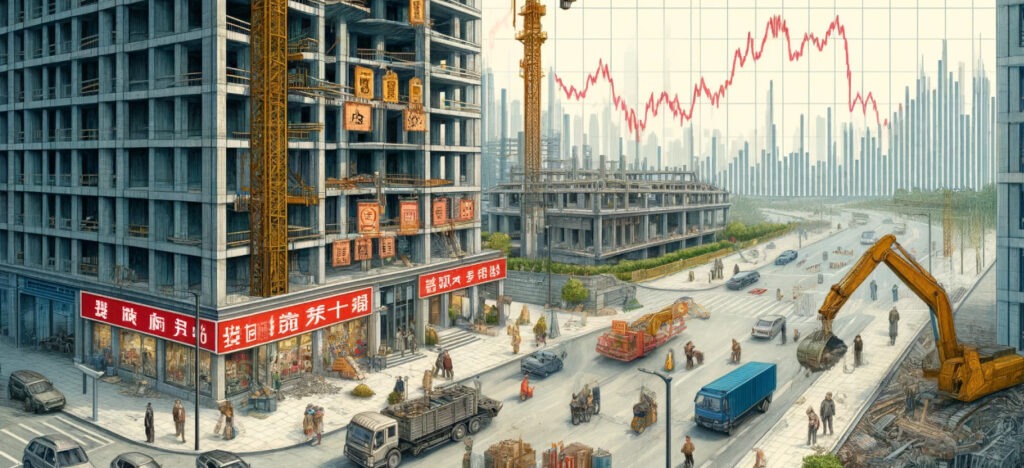

Real estate boom: nearshoring drives 69% growth in six years

The real estate sector in Mexico has experienced significant growth in recent years, driven mainly by the relocation of companies to the country, a phenomenon known as nearshoring.

The real estate sector in Mexico has experienced remarkable growth, with a 69% increase in revenues between Q1 2018 and Q1 2024.

This growth has been driven mainly by the demand for commercial and industrial properties, spurred by the phenomenon of the nearshoring.

The relocation of companies to Mexico has increased the need for logistics and commercial space, which has allowed the sector to compensate for the contraction observed in the housing market, which registered a 42% decrease during the current six-year term.

Although this dynamism in the industrial and commercial market has been a strength for the Mexican economy, reflecting the country's ability to attract foreign investment and capitalize on its proximity to the United States, it also reveals certain structural weaknesses, particularly in the housing sector.

The rise of nearshoring represents a key opportunity for Mexico, strengthening its position as an attractive destination for the relocation of global supply chains.

The construction of 150 industrial parks in the last five years, totaling 10.6 million square meters of rentable area, is a testament to this trend. However, the increasing reliance on foreign investment and relocation as drivers of economic growth also underscores a potential vulnerability.

The lack of diversification in other segments of the real estate market, such as housing, could limit Mexico's ability to sustain this growth over the long term, especially if global dynamics change or if more attractive competitors emerge in other regions.

The slowdown in housing construction poses a threat to the stability of Mexico's housing market. While the commercial and industrial sector continues to expand, the drop in housing construction may have negative consequences for social welfare, affecting access to affordable housing and exacerbating socioeconomic inequalities.

This situation could generate an imbalance in the country's economic development, where growth is not evenly distributed among the different segments of the real estate market.

On the other hand, the increase in the sector's productivity, which increased by 46% between 2018 and 2024, and the improvement in operating margins are positive signs of an industry that has been able to adapt and improve its efficiency.

This rigorous cost control, combined with sustained demand for industrial space, reinforces the sector's strength in the face of economic fluctuations. However, the sustainability of this growth will depend on the country's ability to diversify its real estate supply and to face the threats posed by concentration in certain market segments.

In summary, the Mexican real estate sector is in a position of strength driven by the nearshoring and demand for industrial space, which has allowed for significant growth in income and productivity. However, this expansion is accompanied by challenges and vulnerabilities, especially in the housing market, whose slowdown could have long-term implications for the country's economic and social stability.

Mexico's ability to capitalize on the opportunities of the nearshoring while addressing weaknesses in other market segments will be crucial to ensure balanced and sustainable growth in the future.

Collaboration: Editorial Auge.