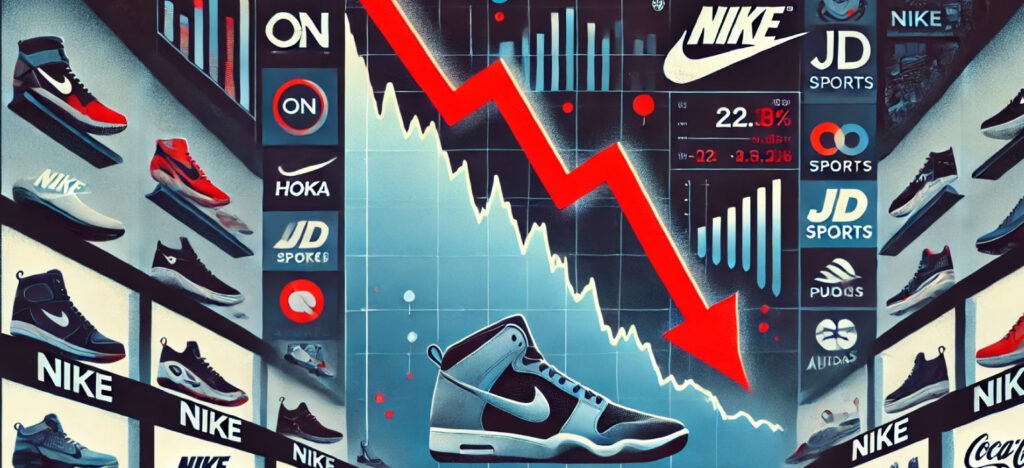

Nike shares plunge as gloomy sales forecast stokes growth concerns

Nike (NKE.N) shares fell 20% on Friday as a forecast for an unexpected drop in annual sales amplified investor concerns about the pace of the sportswear giant's efforts to stem market share loss to emerging brands such as On and Hoka.

Nike (NKE.N) shares fell 20% on Friday as a forecast for an unexpected drop in annual sales amplified investor concerns about the pace of the sportswear giant's efforts to stem market share loss to emerging brands such as On and Hoka.

It was the worst day in the stock's history, and the losses wiped $28.41 billion off the company's market valuation.

On Thursday, the company projected a mid-single-digit percentage decline in FY2025 revenue, compared with analyst estimates of a near 1% increase.

"Nike is at a point where they want to present the most conservative guidance possible, so they set a low bar for themselves and, hopefully, it's a bar they can beat," said Art Hogan, chief market strategist at B Riley Wealth.

Its forecast dragged down shares of rivals and sportswear retailers in Europe, the U.K. and the U.S. on Friday.

British sportswear retailer JD Sports (JD.L) lost 5.4% at Friday's close, while Germany's Puma (PUMG.DE) fell 1%. Adidas (ADSGn.DE) shares were marginally higher.

"Nike has been under pressure for a couple of years. I certainly think they have an opportunity now that the valuation has reset extremely low to start getting some sponsorships, but it's just not going to happen today or this week."

Nike's U.S. market share in the athletic footwear category fell to 34.97% in 2023 from 35.37% in 2022 and 35.40% in 2021, according to GlobalData.

Meanwhile, other sporting goods brands such as Hoka, Asics, New Balance and On accounted for 35% of global market share in 2023 compared to 20% held during the 2013-2020 period, according to an RBC research report published in June.

To stem a worsening sales slump, Nike has reduced oversupply of brands, including Air Force 1, as part of a $2 billion cost-cutting plan launched late last year.

The sportswear giant is also adjusting its product lineup to launch new sub-$100 sneakers in countries around the world to appeal to price-sensitive consumers.

It will also launch this year an Air Max and Pegasus 41 version with full-length foam midsole made of ReactX to boost sustainability.

"This is still Nike and we expect its size and scale to prove to be a long-term competitive advantage, but the burden of proof (is) on management's execution at this point," said Simeon Siegel, analyst at BMO Capital Markets.

Underperformance over the past year has led some Wall Street analysts to raise the possibility of a change in management ahead of the company's investor day this fall.

"In retail, if you have two bad quarters, you're generally out," said Jessica Ramirez, senior analyst at Jane Hali & Associates.

"I think (a change in leadership) is badly needed."

CEO John Donahoe is in his fourth year of a five-year commitment as head of Nike. The former eBay CEO, who succeeded Mark Parker, was hired to focus on strengthening the company's digital channel sales.

"I have seen Nike's plans for the future and believe strongly in them. I am optimistic about Nike's future and John Donahoe has my unwavering confidence and full support," said Phil Knight, co-founder and chairman emeritus, in a statement.

At least six brokerages downgraded the stock and 15 reduced their price targets.

Collaboration: Grupo Auge | Reuters (International).