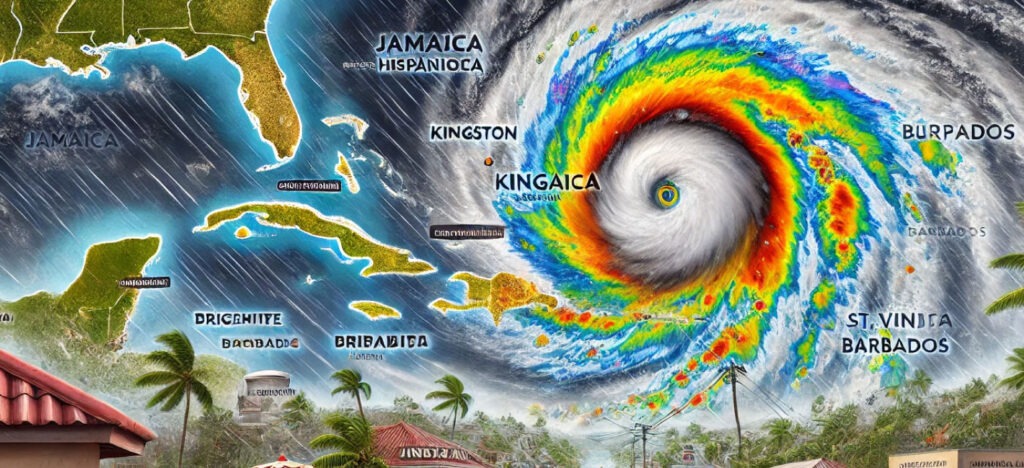

El récord de calor en verano y los huracanes en EE. UU. podrían agitar los precios de los combustibles mientras las refinerías de petróleo se esfuerzan

Una combinación de calor récord y huracanes pondrá a prueba la resiliencia de las refinerías de EE. UU. en las próximas semanas, aumentando el riesgo de precios de los combustibles extremadamente volátiles en plena temporada alta de viajes, dijeron los analistas.

Una combinación de calor récord y huracanes pondrá a prueba la resiliencia de las refinerías de EE. UU. en las próximas semanas, aumentando el riesgo de precios de los combustibles extremadamente volátiles en plena temporada alta de viajes, dijeron los analistas.

La temporada de huracanes en el Atlántico, de junio a noviembre, es una amenaza anual para las refinerías estadounidenses. La mitad de la capacidad de refinación del país, que supera los 18 millones de barriles por día, se encuentra a lo largo de la costa del Golfo, altamente susceptible a las tormentas tropicales. EE. UU. es el mayor mercado de combustibles del mundo.

Este año, las refinerías pueden tener que prepararse para más tormentas de lo habitual. Los pronosticadores del gobierno esperan hasta siete huracanes importantes en los próximos meses, el doble del promedio anual de tres huracanes mayores en el Atlántico con velocidades de viento superiores a 111 millas por hora.

Citgo Petroleum Corp estaba reduciendo la producción en su refinería de Corpus Christi de 165,000 barriles por día el sábado y planea operar la instalación al mínimo durante el paso de la tormenta tropical Beryl sobre la costa de Texas, dijeron fuentes.

Los puertos más grandes de Texas también cerraron operaciones y tráfico de embarcaciones en preparación para Beryl, que se espera se fortalezca nuevamente a huracán antes de llegar al área a principios del lunes.

La intensidad y el momento de Beryl, que en un momento se convirtió en el huracán de categoría 5 más temprano en la historia, señalan una temporada activa y disruptiva por delante, dijo Neil Crosby, analista de mercado de crudo en Sparta Commodities.

“Los huracanes siguen siendo el mayor comodín para los precios de la gasolina”, dijo Patrick De Haan, analista de GasBuddy. “No hay mejor recordatorio de eso que Beryl”, añadió.

Las órdenes de evacuación antes de las tormentas pueden aumentar el almacenamiento y aumentar la demanda de combustible, haciendo que los precios de la gasolina, el diésel y otros productos refinados suban, dijo De Haan.

Si una tormenta importante golpea el sistema de refinación de la costa del Golfo, podría eliminar hasta un millón de barriles por día de suministro de combustible y provocar cortes prolongados o incluso cierres permanentes, según la Administración de Información de Energía de EE. UU. (EIA).

Los huracanes que se dirigen a la costa del Golfo también podrían interrumpir una cantidad similar de suministro de crudo, ya que la región offshore del Golfo de México alberga alrededor del 14% de la producción de crudo de EE. UU.

En 2021, las empresas de petróleo y gas de EE. UU. suspendieron más de 1.7 millones de barriles de producción de petróleo después del huracán Ida.

Las interrupciones de alrededor de 1.5 millones de barriles por día de producción de crudo y capacidad de refinación pueden causar que los precios de la gasolina suban entre 25 y 30 centavos, según la EIA.

Además de los huracanes, las refinerías este año deben enfrentarse a más problemas relacionados con el calor abrasador.

El récord de calor y la temporada de huracanes en EE. UU. aumentan el riesgo de volatilidad en los precios de los combustibles. Las refinerías, vulnerables a estos fenómenos, podrían enfrentar cortes de suministro y aumentos de precios, complicando la situación durante la temporada alta de viajes.

El último pronóstico mensual de temperaturas de EE. UU. prevé temperaturas superiores al promedio en grandes partes del país en julio, típicamente el mes más caluroso.

Las temperaturas excesivas tienen efectos exagerados en las cadenas de suministro de materias primas, incluido el petróleo y los combustibles, escribieron analistas de JPMorgan el mes pasado.

La mayoría de las refinerías están diseñadas para operar entre 32 y 95 grados Fahrenheit. Las temperaturas de tres dígitos podrían provocar fallas en los equipos y una reducción en la capacidad de refinación.

El calor extremo del año pasado provocó una reducción de 500,000 barriles por día en la producción de productos refinados de la costa del Golfo, escribieron los analistas de JPMorgan.

Efectos similares se están sintiendo este año. Los problemas de unidades reportados por Phillips 66 en su refinería de Wood River en Illinois el mes pasado probablemente se debieron a las olas de calor, según Kloza y otros expertos de la industria.

Una temporada de mantenimiento robusta a principios de este año permitió a las refinerías de EE. UU. realizar importantes actualizaciones y mantenimientos detallados que se habían pospuesto repetidamente debido a la creciente demanda post-pandémica y las interrupciones en el suministro.

Eso debería, en teoría, hacer que las refinerías estén mejor preparadas para la temporada de huracanes, dijo Alex Hodes, analista de petróleo en la correduría StoneX.

La lenta demanda en los últimos meses también ha ayudado a las refinerías a acumular reservas de combustible, lo que debería actuar como un colchón en caso de interrupciones.

Las reservas de gasolina de EE. UU. han aumentado en aproximadamente 4 millones de barriles desde principios de abril hasta casi 231.7 millones de barriles el 28 de junio, en línea con el promedio estacional de los últimos cinco años, excluyendo 2020.

Las reservas de destilados, incluidos el diésel y el aceite de calefacción, han crecido en 3.7 millones de barriles desde principios de abril y estaban en 119.7 millones de barriles el 28 de junio, ligeramente por debajo del promedio histórico, excluyendo 2020, cuando las reservas se elevaron bruscamente debido a la destrucción de la demanda relacionada con el COVID.

“No hay mucho margen de error”, dijo Tom Kloza, jefe de análisis de energía en Oil Price Information Service. “Estoy esperando ver qué pasa”.

Colaboración: Grupo Auge | Reuters (Internacional).