China's exports beat forecasts, but falling imports point to more stimulus

China's exports grew at the fastest pace in 15 months in June, suggesting that manufacturers are bringing forward orders in the face of expected tariffs from a growing number of trading partners, while imports unexpectedly declined due to weak domestic demand.

China's exports grew at the fastest pace in 15 months in June, suggesting that manufacturers are bringing forward orders in the face of expected tariffs from a growing number of trading partners, while imports unexpectedly declined due to weak domestic demand.

Mixed trade data keeps the need for more government stimulus alive as the 1TP4Q18.6 trillion economy struggles to recover. Analysts caution that it is still unclear whether the strong export sales of recent months can be sustained as major trading partners are becoming more protective.

"This reflects the economic condition in China, with weak domestic demand and strong production capacity relying on exports," said Zhiwei Zhang, chief economist at Pinpoint Asset Management. "The sustainability of strong exports is a major risk to the Chinese economy in the second half of the year. The economy in the United States is weakening. Trade conflicts are worsening."

Overseas shipments from the world's second-largest economy grew by 8.6% year-on-year in value in June, customs data showed Friday, beating a forecast rise of 8.0% in a survey of economists and a 7.6% increase in May.

But imports hit a four-month low, declining by 2.3% compared to a forecast increase of 2.8% and a 1.8% increase the previous month, highlighting the fragility of domestic consumption.

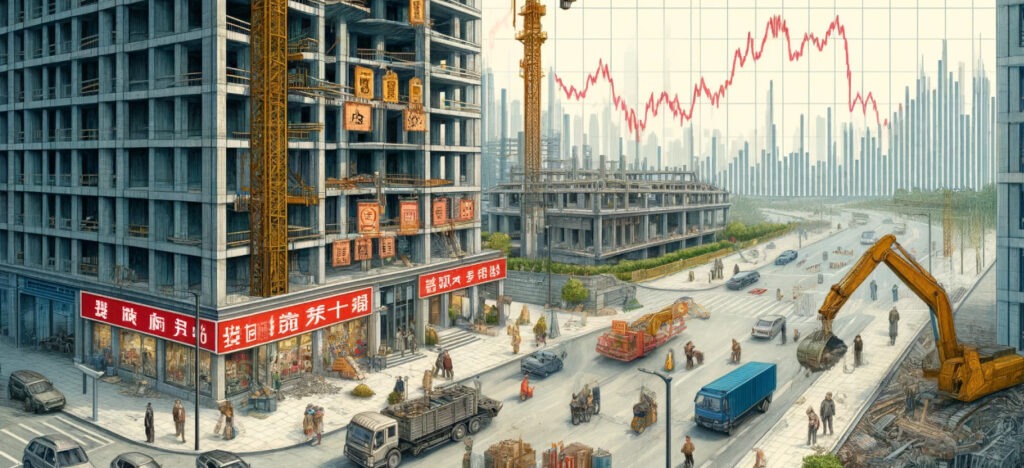

Stronger-than-expected exports have been one of the few bright spots for an economy otherwise struggling to gain momentum despite official efforts to stimulate domestic demand in the aftermath of the pandemic. A lingering housing crisis and concerns about employment and wages are weighing heavily on consumer confidence.

Still, as the number of countries imposing restrictions on Chinese products increases, so does the pressure on their exports to underpin progress toward the government's economic growth target for this year of around 5%.

China's trade surplus stood at $99.05 billion in June, the highest in records dating back to 1981, compared to a forecast of $85 billion and $82.62 billion in May. The United States has repeatedly highlighted the surplus as evidence of one-sided trade favoring the Chinese economy.

Washington in May increased tariffs on a range of Chinese imports, quadrupling duties on Chinese electric vehicles to 100%. Brussels confirmed last week that it would impose tariffs on electric vehicles, but only up to 37.6%.

Chinese exporters are also on edge ahead of the U.S. elections in November, in case either major party imposes new trade restrictions.

Last month, Turkey announced it would impose an additional 40% tariff on electric vehicles made in China, and Canada said it was considering restrictions.

Meanwhile, Indonesia plans to impose tariffs of up to 200% on textile products, which come mainly from China; India is monitoring cheap Chinese steel; and talks with Saudi Arabia on a free trade agreement have apparently stalled over dumping concerns.

The decline in imports may not bode well for exports in the coming months, as just under one-third of China's imports are parts for re-export, particularly in the electronics sector.

China imported only slightly more chips in volume terms in June than it did a year ago, suggesting that China's heavy investment in expanding production of older chips, known as legacy chips and found in everything from smartphones to fighter jets, is distorting supply and demand.

The European Commission has reportedly begun consulting the bloc's semiconductor industry on the expansion of legacy chip production in China, which could restrict the Asian giant's strong export performance in the electronics sector.

Also, pointing to weak domestic demand, China's steel exports in the first half of the year were up 24% from a year earlier, pointing to a declining construction sector, which is a major consumer of the metal.

Chinese stocks followed regional markets lower, with mixed trade data affecting sentiment.

Analysts expect China to implement more short-term support measures, and a government commitment to increase fiscal stimulus is expected to help boost domestic consumption.

"It seems that the government's biggest bond issuance since May has yet to translate into increased infrastructure spending and commodity demand," said Zichun Huang, China economist at Capital Economics. "But we expect this to happen soon, boosting the import-intensive construction sector," he said.

Economists and investors are looking forward to the Third Plenum to be held July 15-18, with hundreds of China's top Communist Party officials gathering in Beijing for a meeting held every five years.

Collaboration: Grupo Auge | Reuters (International).